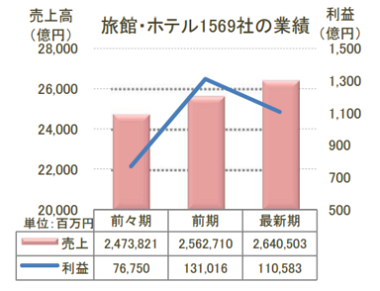

The Tokyo Shoko Research’s survey on the business trend of hotels and ryokans in Japan finds that revenue totaled 2,641 billion JPY in the latest term (September 2014 to August 2015), 3.0% more than a year earlier. Profit, however, reduced to 110.6 billion JPY in total from 131 billion JPY in total a year earlier.

The survey was conducted to 1,569 hotels and ryokans nationwide that disclosed their sales for three years in a row. The table below shows changes of revenue and profit in the past three years.

Hotels and ryokans with an increase in revenue reduced to 757 (48.2% of the total) from 862 (54.9% of the total), while those with a decrease in revenue increased to 238 (15.2% of the total) from 186 (11.9% of the total). Hotels and ryokans with revenue unchanged were 574 (36.6% of the total), more than 521 (33.2% of the total) a year earlier. Hotels and ryokans with an increase in profit accounted for 41% of the total, while those with a decrease in profit for 35.8%.

By region, Kinki has the most hotels and ryokans with an increase in revenue (64.6%), followed by Kanto (59.5%) and Hokkaido (51.1%).

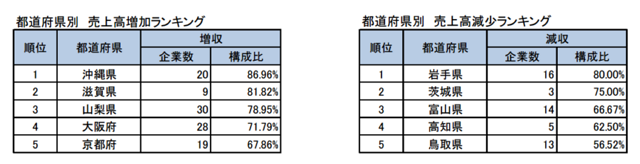

By prefecture, Okinawa has the most hotels and ryokans with an increase in revenue (86.96%), followed by Shiga (81.82%) and Yamanashi (78.95%). Iwate has the most hotels and ryokans with a decrease in revenue (80%), followed by Ibaraki (75%) and Toyama (66.67%).

In the meantime, Teikoku Date Bank has recently reported that bankrupt hotels and ryokans in 2015 were up 8.9% to 86, which represented the first year-on-year growth in the past four years. While bankruptcies increased in Hokkaido, Kanto, Hokuriku and Chubu, those reduced in Kinki, Chugoku/Shikoku and Kyushu.

Out of the bankruptcies in total, special liquidations accounted for 20% or more, which might result from more business transfers to new companies for rehabilitations.

In Japanese