A survey by Tokyo Shoko Research (TSR) finds that the number of bankrupt, closed or dissolved travel companies reached a total of 107 in FY2016 (ending on 31 March 2017). 27 companies went bankrupt; 80 were closed or dissolved (69 more than in FY2015).

More than 60 companies have been closed or dissolved every year since FY2008; including bankruptcies, about 100 companies have disappeared every year since FY2013.

In FY2016, 33 companies with a capital of 10 million JPY or less closed or were dissolved (41.2% of the 80); adding 4 one-man businesses as well as small or very small companies that closed or were dissolved, half of the total is reached. No company with a capital of 100 million JPY or more closed or was dissolved.

The graph below illustrates the number of bankrupt, closed and dissolved companies every fiscal year since 2000:

The sales of 1,700 travel companies nationwide totaled 2,624 billion JPY in FY2016, 2.2% or 60.9 billion JPY less than in FY2015. The domestic travel market was affected by Kumamoto Earthquake in April 2016 and the impressive typhoon that hit the Tohoku and Hokkaido in August 2016. According to TSR, the series of terrorist attacks in Europe damaged the overseas travel market. Finally, the total income fell by 45.6% year on year, reaching 15.6 billion JPY.

The graph below illustrates the business results of 1,700 travel companies during the past three fiscal years:

777 companies had sales of 100 million JPY or less (45.7% of the 1,700 companies). Adding 619 companies with sales of 100 million to 500 million JPY (36.4%) and 118 companies with sales of 500 million to 1 billion JPY (6.9%), 1,514 companies with sales of 1 billion JPY or less accounted for 89% of the total.

The aggregated sales of the 34 companies with sales of 10 billion JPY or more reached 1,952 billion JPY, accounting for 74.3% of the total sales.

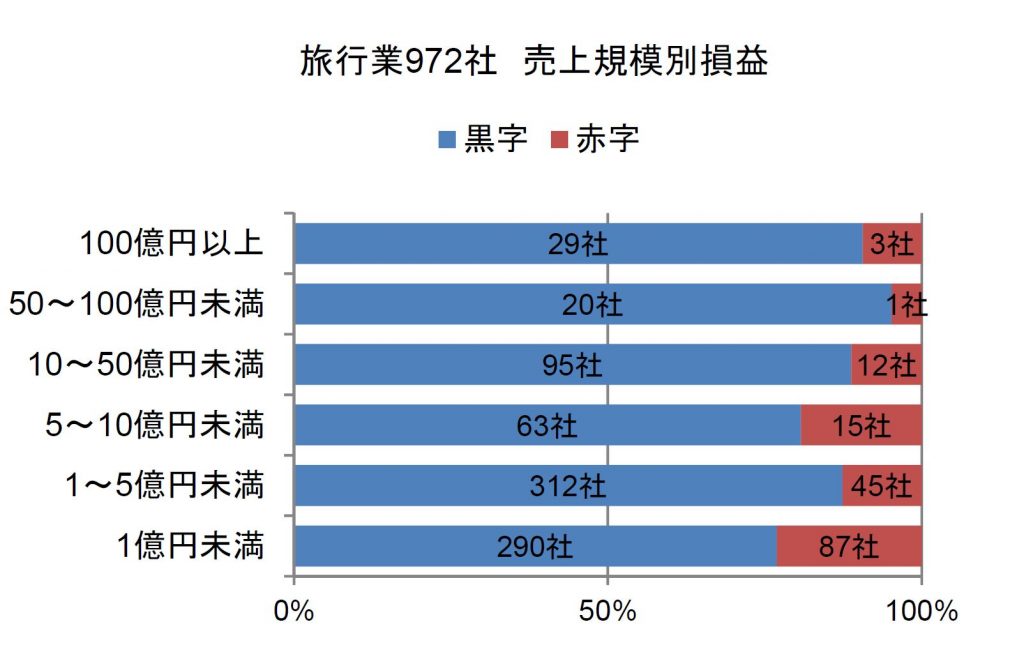

Looking at the 972 companies that disclosed their sales/income in FY2016, 87 out of the 377 companies with sales of 100 million JPY or less (almost one fourth) posted deficits. However, only 4 out of the 53 companies with sales of 5 billion or more posted deficits. Among the 812 companies with sales of 1 billion JPY or less, 147 (18.1%) posted deficits.

The graph below illustrates the profits & losses of the 972 travel companies, grouped by sales-scale: