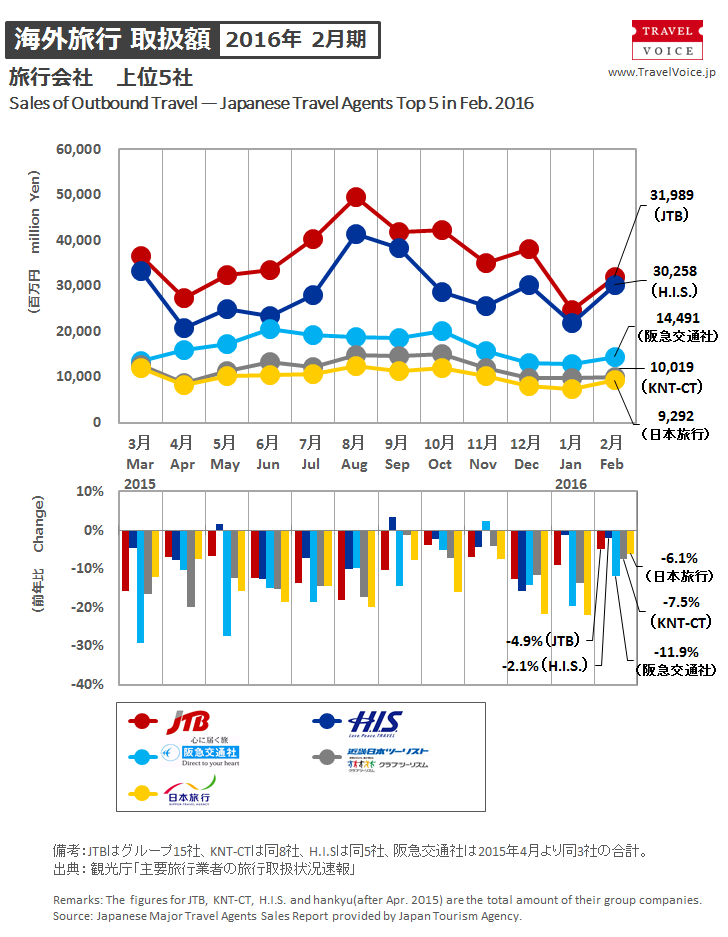

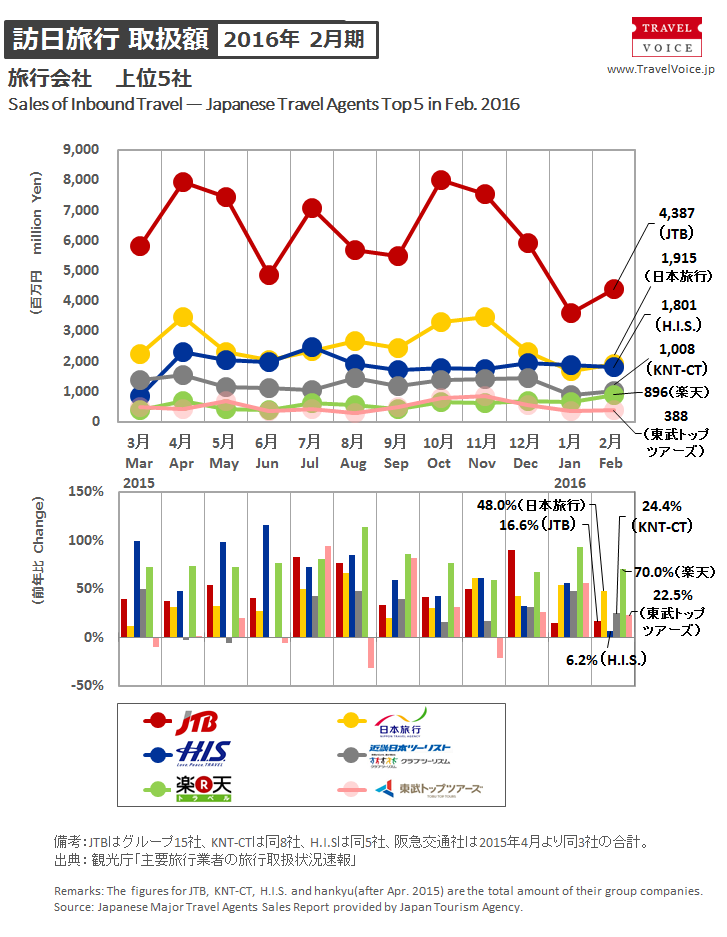

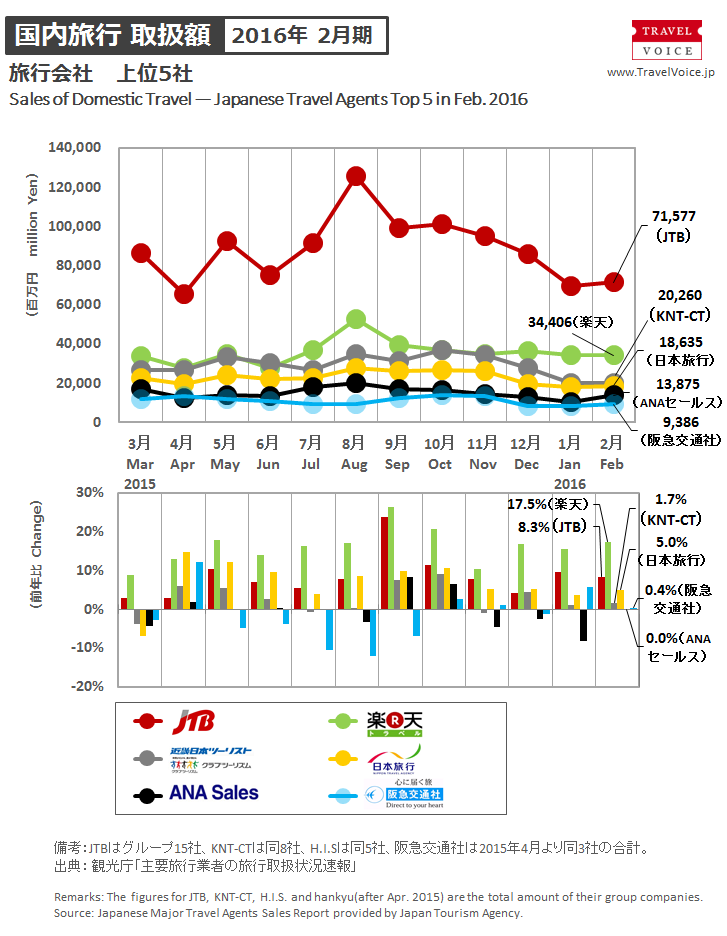

Japan Tourism Agency reported that travel transactions of 49 major travel agents totaled 474.9 billion JPY (+3.2%) in February 2016. The monthly total consisted of 154.4 billion JPY for outbound travel (-4.0%), 11.5 billion JPY for inbound travel (+26.3%) and 309 billion JPY (+6.5%) for travel in Japan. The monthly reduction rates for outbound travel were smaller for two months in a row.

All of the top five travel agents (JTB, H.I.S., Hankyu, KNT-CT and NTA) resulted in year-on-year reductions of outbound travel transactions, and the difference of transactions between 1st JTB and 2nd H.I.S was shrunk to 1.7 billion JPY.

Among the top five travel agents for inbound travel transactions, NTA moved up to 2nd, increasing the transactions by 48%. Rakuten Travel maintained 5th with the monthly growth of 70%.

In the travel in Japan market, Rakuten Travel (2nd) achieved double-digit monthly growths for 11 months in a row since April 2015.

Transactions of package tour brand products totaled 118.9 billion JPY in February 2016 (+1.4%) with 2.986,346 customers in total (-0.7%). The monthly total comprised 475 million JPY (+16.8%) with 30,626 customers (+45.7%) for inbound travel, 46.6 billion JPY (-2.8%) with 283,116 customers (-2.9%) for outbound travel and 72 billion JPY (+4.2%) with 2,672,604 customers (-0.9%) for travel in Japan.

According to the hearings to travel agents, travelers from East Asia and Southeast Asia continued growing in the inbound travel market, boosted by ease of the visa rules. In the travel in Japan market, popularity of travel to Hokuriku or Tohoku was still high. In the outbound travel market, weak yen and terrorist attacks in Europe continued discouraging Japanese travelers to go abroad for leisure particularly to Europe.

In Japanese