Japan Tourism Agency reported that travel transactions of 49 major travel agents totaled 6,636.3 billion JPY (+3.2%) in FY2015 ending March 31 2016. The yearly total consisted of 2,018.6 billion JPY for outbound travel (-8.4%), 174.2 billion JPY for inbound travel (+44.0%) and 4,443.5 billion JPY (+8.3%).

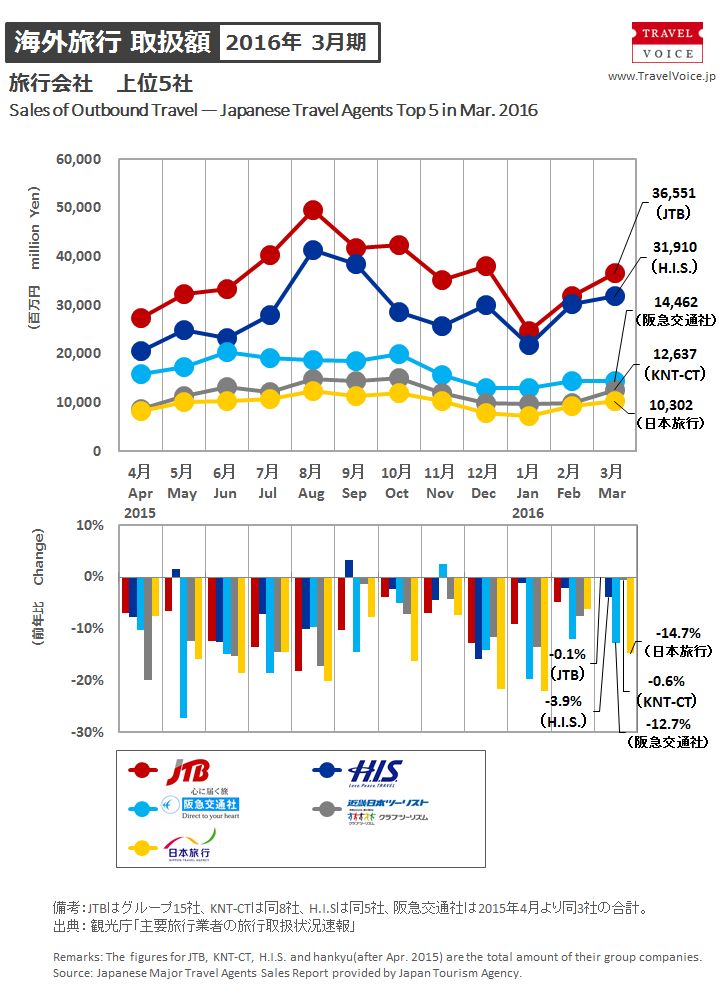

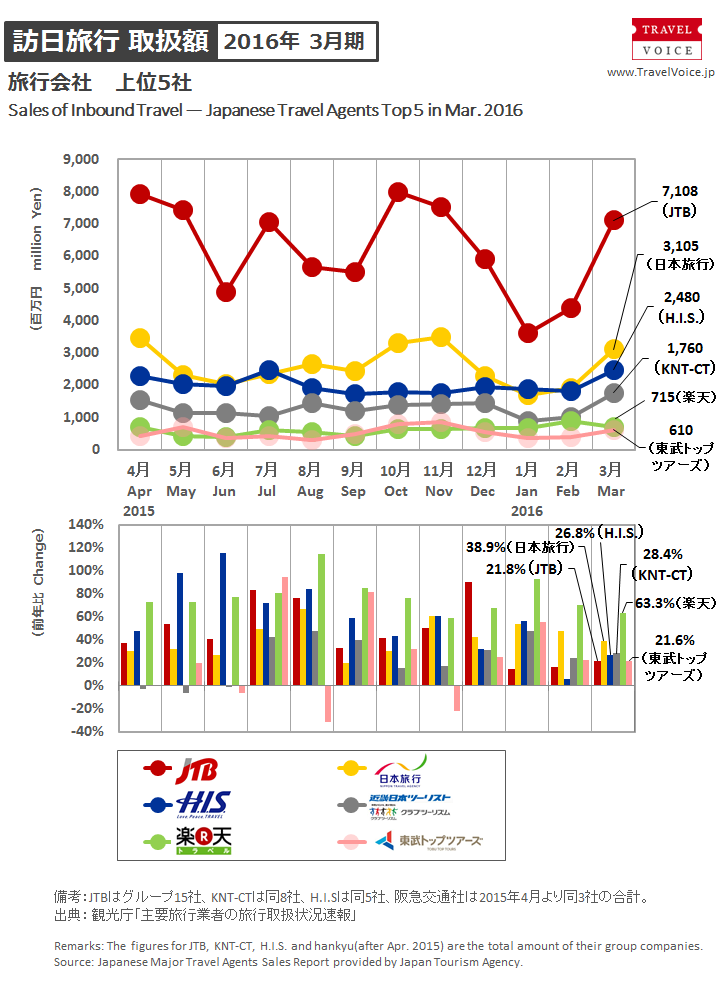

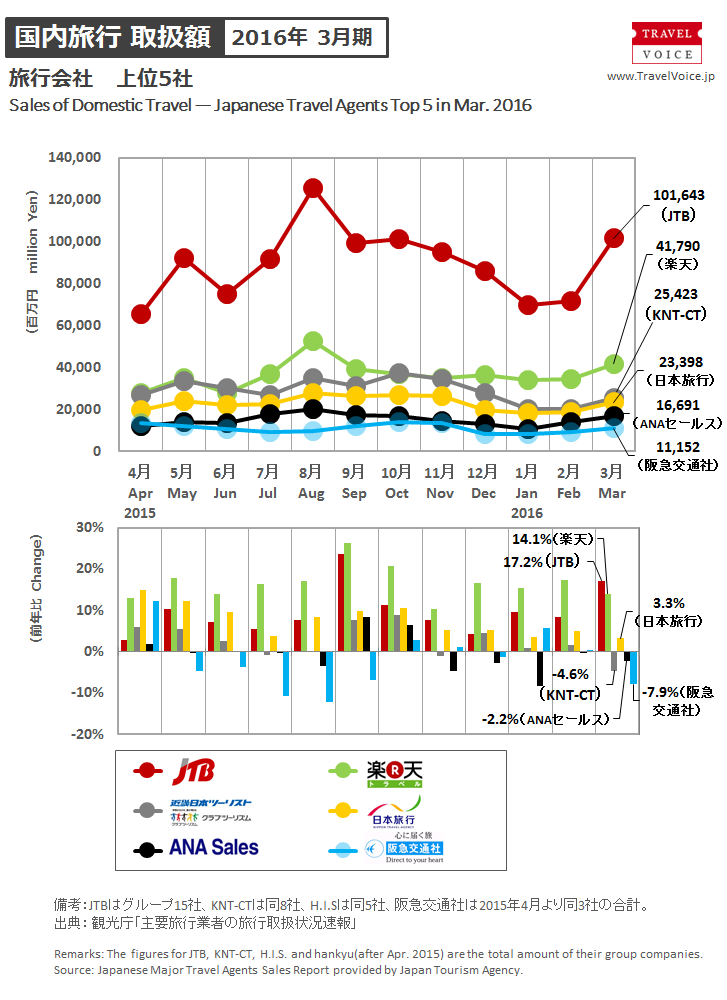

Out of the top five travel agents (JTB, H.I.S., Hankyu, KNT-CT and NTA), H.I.S. and KNT-CT resulted in year-on-year reductions of yearly transactions. Top was JTB with yearly transactions of 1,500 billion JPY. All of the top five travel agents reduced outbound travel transactions, while they increased both inbound travel and travel in Japan transactions.

For the last four months of FY2015, all of the top five agents resulted in year-on-year reductions of outbound travel transactions, and 2nd H.I.S. approached 1st JTB. In terms of inbound travel transactions, 2nd H.I.S. and 3rd NTA were very close, and 4th Rakuten Travel and 5th Tobu Top Tours were very close. In the travel in Japan market, JTB was stably No.1, and Rakuten Travel had maintained 2nd for five months in a row since November 2015.

Transactions of package tour brand products totaled 1,692.4 billion JPY in FY2015 (-2.0%) with 38,710,958 customers in total (-2.3%). The total comprised 648.3 billion JPY (-11.3%) with 3,171,422 customers (-11.1%) for outbound travel, 6.6 billion JPY (+23.8%) with 402,113 customers (+44.6%) for inbound travel and 37.5 billion JPY (+4.8%) with 35,137,423 customers (-1.7%) for travel in Japan. In the inbound travel market, the growth rate of customers was smaller than that of transactions, which meant unit price was lower.

In Japanese