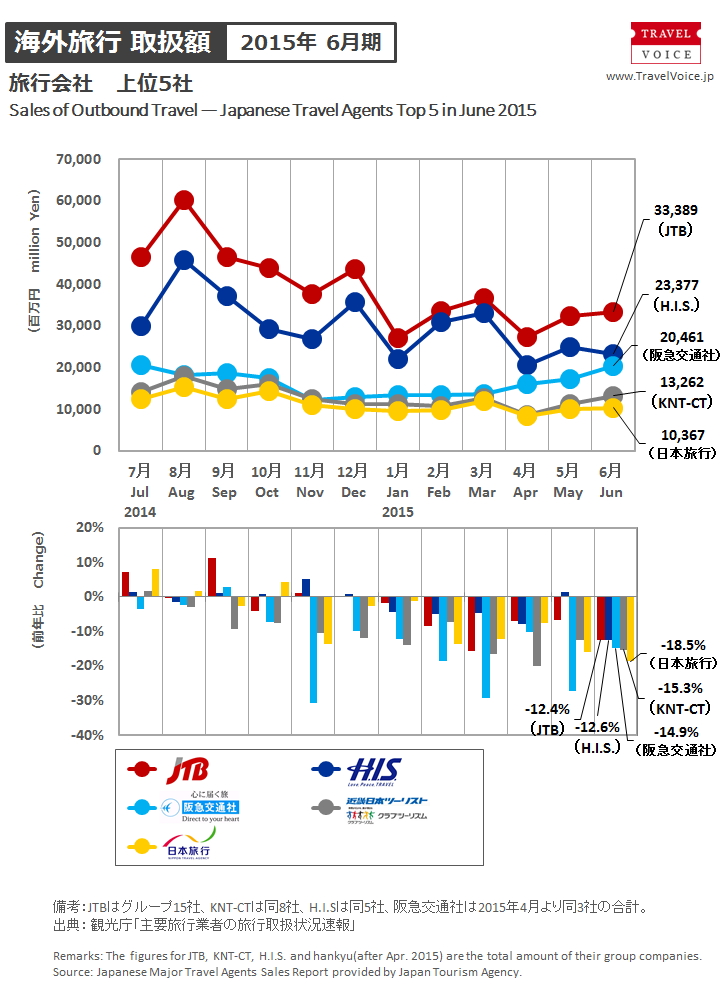

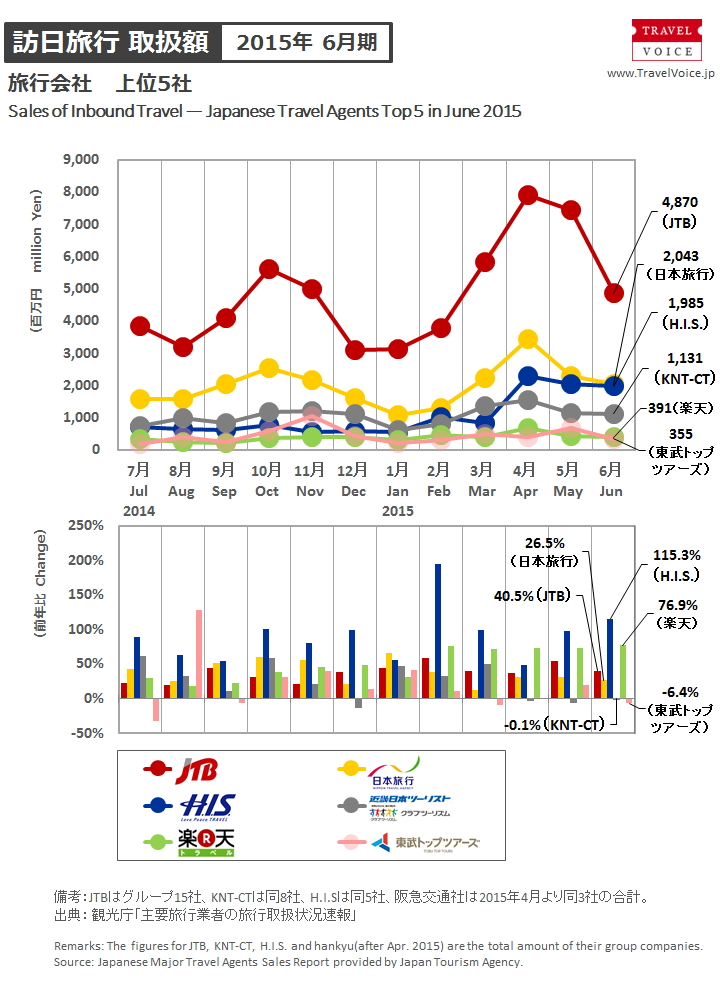

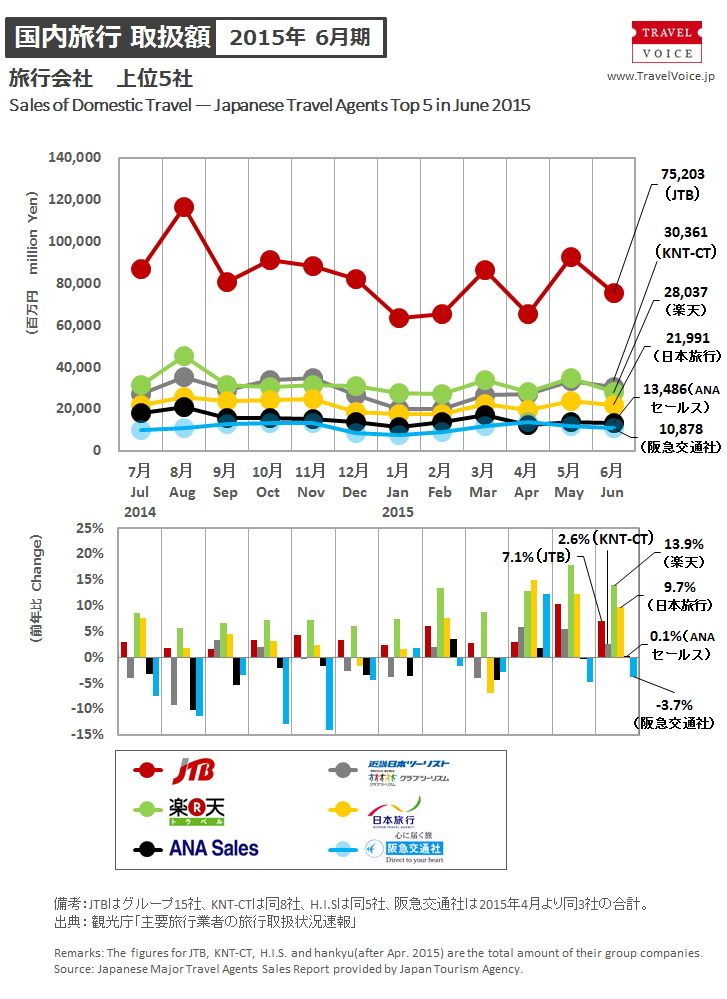

Japan Tourism Agency (JTA) recently reported that travel transactions in June 2015 totaled 499.5 billion JPY (unchanged from a year earlier), which consisted of 162 billion JPY for outbound travel (-11.9%), 11.6 billion JPY for inbound travel (+38.6%) and 325.9 billion JPY for travel in Japan (+6.0%).

All of the top five travel agents (JTB, H.I.S., Hankyu, KNT-CT and NTA) resulted in year-on-year reductions for outbound travel as follows:

In the inbound travel market, the top was JTB in June 2015, followed by NTA, H.I.S. and KNT-CT, following May 2015. OTA Rakuten raised it ranking to 5th, and Tobu Top Tours ranked 6th. The largest growth of transactions was found in H.I.S. (+115.3%), followed by Rakuten (+76.9%).

In the travel in Japan market, all of the top five travel agents (JTB, KNT-CT, Rakuten, NTA and ANA Sales) succeeded in year-on-year growths of transactions. KNT-CT came back to 2nd for the first time since November 2014, and Rakuten resulted in the year-on-year growth of 13.9%. ANA Sales (5th) and Hankyu (6th) still competed each other at close transactions.

Transactions of package tour brand products totaled 115.4 billion JPY in June 2015 (-5.5%) with 2,569,645 customers in total (-3.9%), which comprised 472 million JPY (+31.8%) with 28,747 customers (+49.7%) for inbound travel, 47 billion JPY (-16.3%) with 210,824 customers (-15.7%) for outbound travel and 67.9 billion JPY (+3.5%) with 2,330,074 customers (-3.1%) for travel in Japan.

The growth rate of transactions was lower than that of customers in inbound travel, and customers reduced, but transactions increased in travel in Japan.

According to the hearings to travel agents, travelers from East Asia and Southeast Asia continued growing in the inbound travel market for a main reason of ease of visa rules. In the travel in Japan market, popularity of travel to Kansai and Hokuriku was still high. In the outbound travel market, demand for Europe continued stagnating.

In Japanese