Japan Tourism Agency (JTA) announced that the sales of the 50 major Japanese travel agents amounted to 404.5 billion JPY in April 2017 (+0.8%), 470.5 billion JPY in May 2017 (+9.6%) and 452.2 billion JPY in June 2017 (+4.8%).

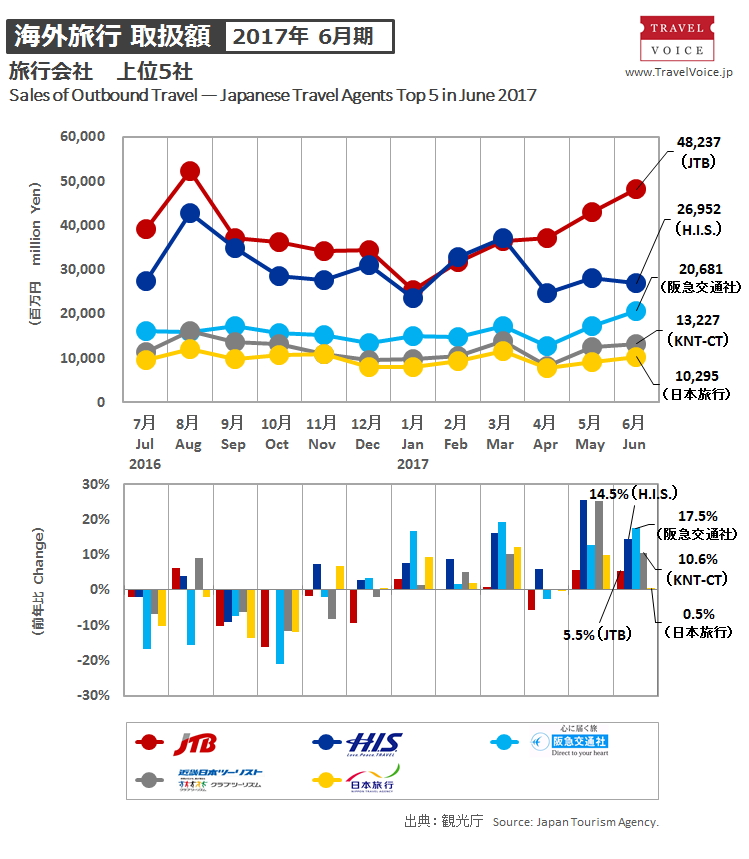

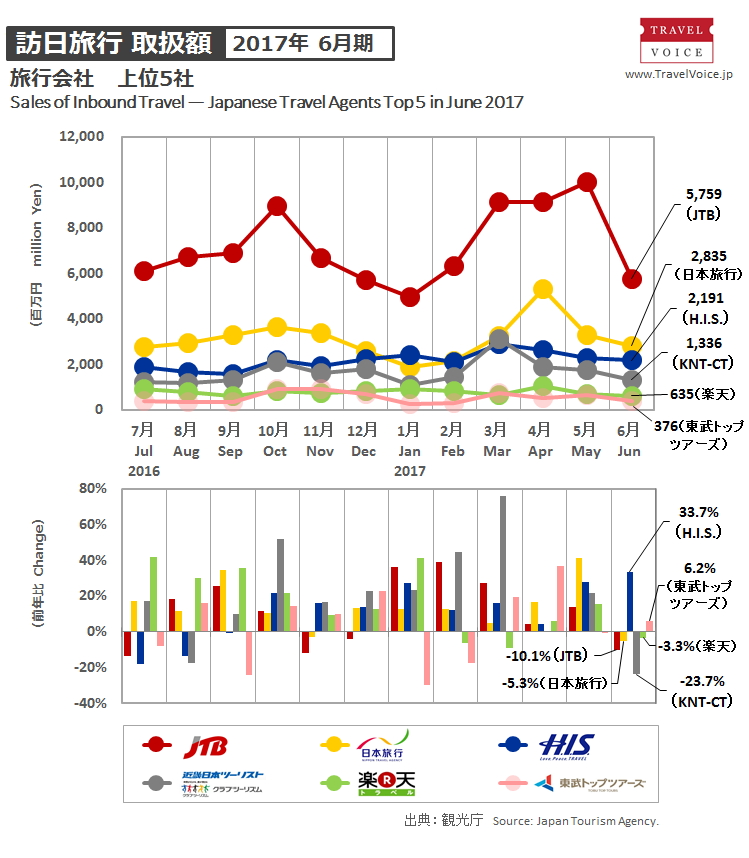

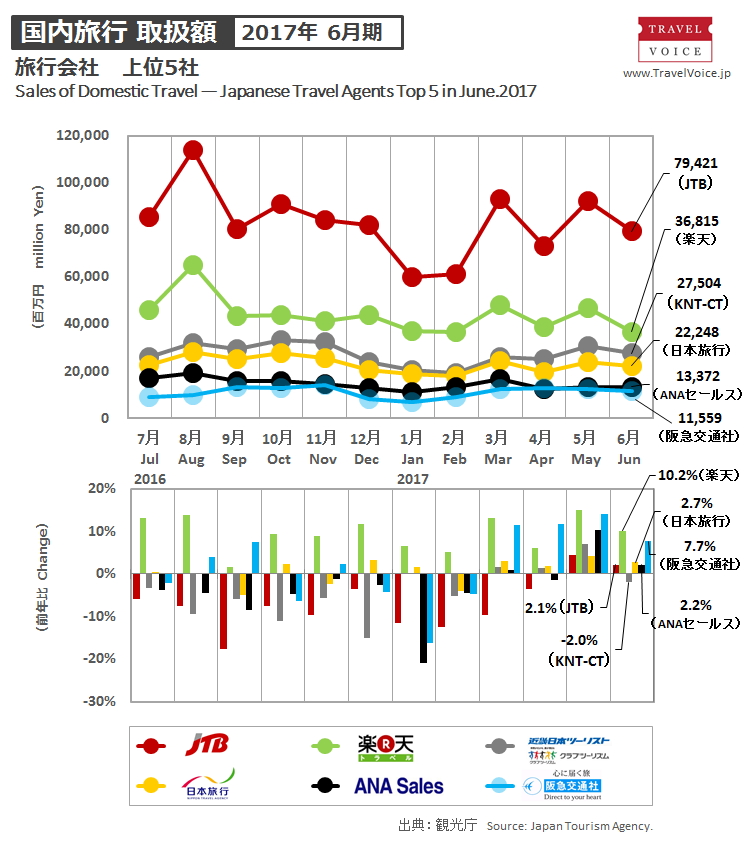

Regarding the outbound travel business, the sales amounted to 132.4 billion JPY in April 2017 (+0.2%), 155.6 billion JPY in May 2017 (+12.7%) and 169.6 billion JPY in June 2017 (+9.0%). Regarding the inbound travel business, the sales amounted to 23.2 billion JPY in April 2017 (+8.0%), 20.8 billion JPY in May 2017 (+19.2%) and 14.7 billion JPY in June 2017 (-2.9%). Regarding the domestic travel business, the sales amounted to 248.9 billion JPY in April 2017 (+0.6%), 294.2 billion JPY in May 2017 (+7.5%) and 268 billion JPY in June 2017 (+2.8%).

NOTE: From April 2017, JTB Group aggregates 25 companies instead of 15, and View Travel Service, STA Travel, TEC Air Service and Nikko Travel were added to the sales report. Japan Tourism Agency consequently targeted 50 companies for this sales report.

Regarding the outbound travel business, the top five travel agents (25 JTB group companies, Rakuten, eight KNT-CT group companies, five H.I.S. group companies, NTA) all increased their sales on a year-on-year basis. H.I.S., Hankyu and KNT-CT even reached a double-digit growth.

Regarding the inbound travel business, 3 of the 5 top travel agents (25 JTB group companies, Rakuten, eight KNT-CT group companies, five H.I.S. group companies, NTA) lost sales on a year-on-year basis (JTB, KNT-CT, NTA) while H.I.S. grew by 33.7% growth. Tobu Top Tours, competing with Rakuten for the 5th place last year, remained 6th although it ranked 5th in March 2017 for the first time since November 2016.

Regarding the domestic travel business, 4 of 5 top companies (25 JTB group companies, eight KNT-CT group companies, NTA, Rakuten, ANA Sales) increased their sales; only KNT-CT lost sales on a year-on-year basis. In April 2017 only, Hankyu ranked 5th thanks to a growth of 11.6%, briefly overtaking ANA sales.

The sales of package tour brand products totaled 138.9 billion JPY (+0.9%) with 2,714,291 customers (-0.8%) in April 2017, 155.8 billion JPY (+10.8%) with 2,690,171 customers (+7.7%) in May 2017, and 103.3 billion JPY (+3.8%) with 2,581,875 customers (+1.8%) in June 2017.

According to the travel companies, the outbound travel market was boosted by the recovery of travelers for Europe and an increase in travelers for Hawaii and Micronesia during the Golden Week (period in May). Regarding the inbound travel market, an increase in travelers from South Korea contributed to the growth of sales in April and May but the market was affected in June by a backlash from a large scale MICE last year. Regarding the domestic travel market, a recovery from the effects of April 2016 Kumamoto Earthquake was visible.