On 15 September 2017, Japan Tourism Agency (JTA) held a first expert meeting to discuss the creation of a new financial resource for tourism, as part of the goal of making Japan a tourism-oriented country. JTA plans to incorporate the conclusion of a mid-term review (expected in November 2017) into the package of tax revisions for FY2018.

Four questions were considered: 1) Who are the beneficiaries (or who has a responsibility for a financial resource)? 2) How can the new financial resource be used? 3) How would the financial resource influence the inbound travel market? 4) What would be a right way to guarantee the financial resource?

The members of the meeting all agreed that a new tourism financial resource is necessary. However, some said it is necessary to discuss who is responsible or how to use such a new resource because tourism is a complicated industry.

Regarding Question 1, JTA suggested that the beneficiaries could be the Japanese as well as the international visitors. On the Japanese side, 3 views emerged during the meeting: (1) the beneficiaries should be industries or businesses directly relevant to tourism, (2) the beneficiaries should not be limited to particular industries or businesses, and (3) Japanese people can be beneficiaries in terms of improvement of travel convenience e.g. smoother immigration or extended aerial network.

A member said that it makes sense to make international visitors beneficiaries, while asserting that it is important to show concrete merits for Japanese people if the Japanese are targeted as beneficiaries.

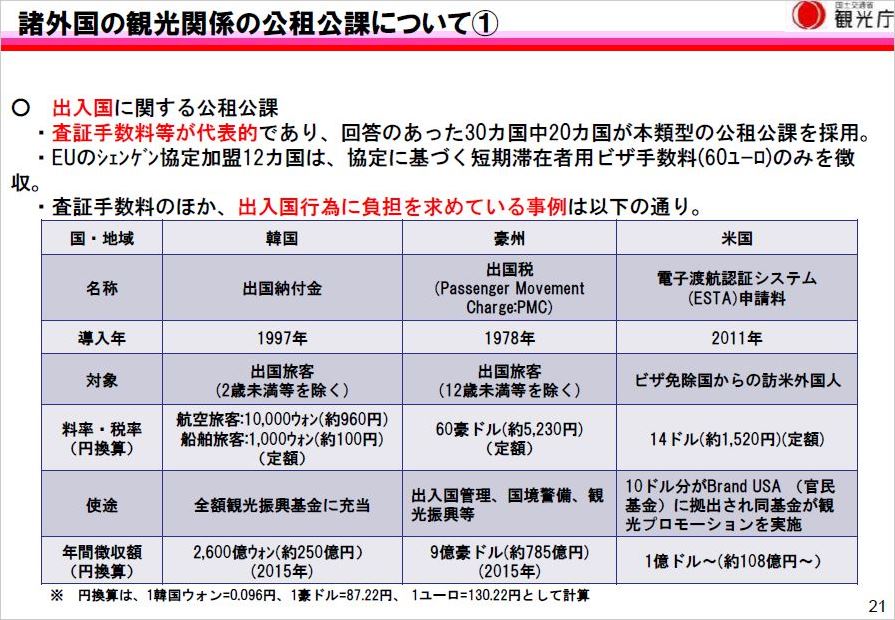

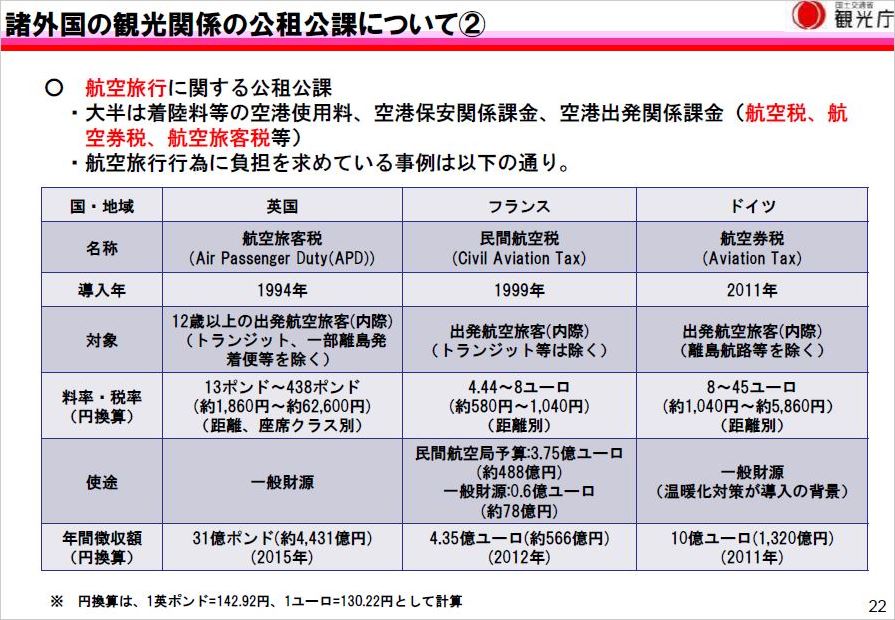

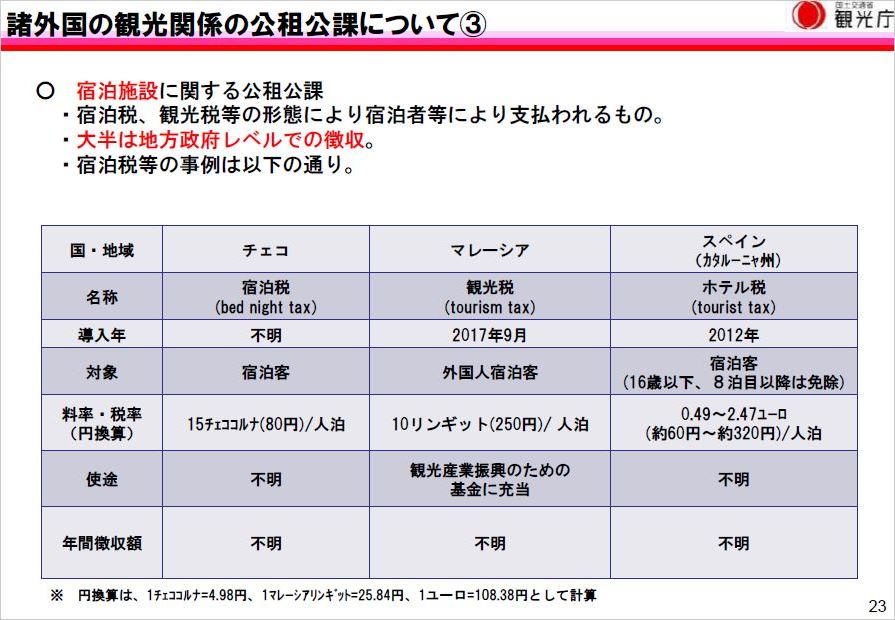

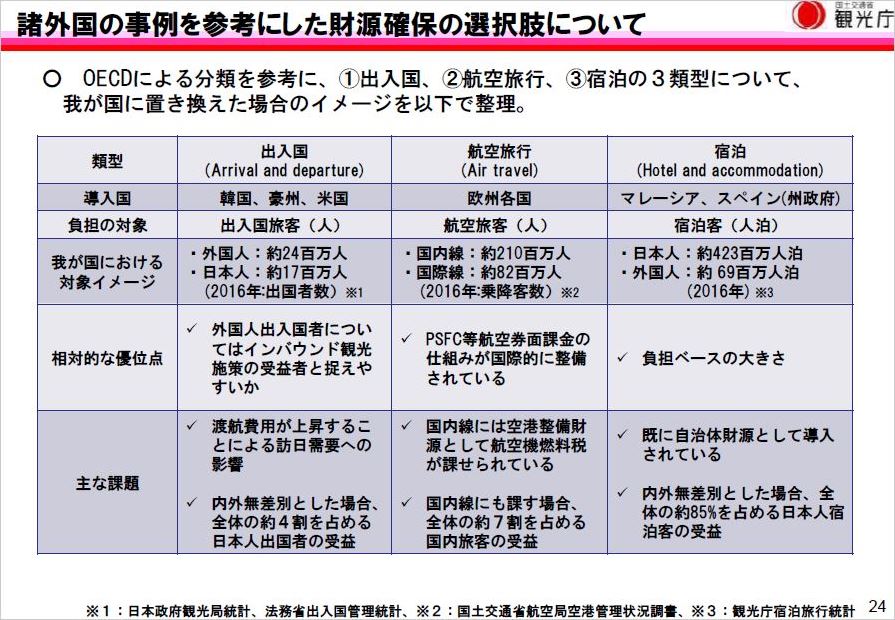

Regarding Question 4, taxes and commissions were considered. Using the OECD's classification, JTA introduced tourism taxation systems from all over the world, with a focus on taxation systems for "arrival/departure", "air travel" and "hotel/accommodation".

Regarding Question 2, the members all agreed that a new financial resource should be used for tourism policies, such as tourism promotions for international visitors or the development of environments to receive them.

Some members pointed out that the new resource should be used to update/renew tourism resources related to national parks or cultural heritages, or should be used to develop inbound human resources in the frame of DMOs.

To answer Question 3, the members will hear from airlines, accommodations, tourism-related organizations including Japan Association of Travel Agents (JATA), and local governments in late September and early October 2017.

A reference for taxation on arrival or departure is the American ESTA. As the Ministry of Justice, which controls immigration, has requested a budget to study the creation of a "Japanese ESTA" in FY2018, it seems difficult to introduce an ESTA-like tourism resource this time.

The tables below describe examples of tourism taxation in foreign countries: