Japan Tourism Agency reported that travel transactions of 49 major travel agents totaled 573.4 billion JPY (+2.6%) in November 2015. The monthly total consisted of 160.4 billion JPY for outbound travel (-6.0), 17.3 billion JPY for inbound travel (+44.7%) and 395.7 billion JPY (+5.2%).

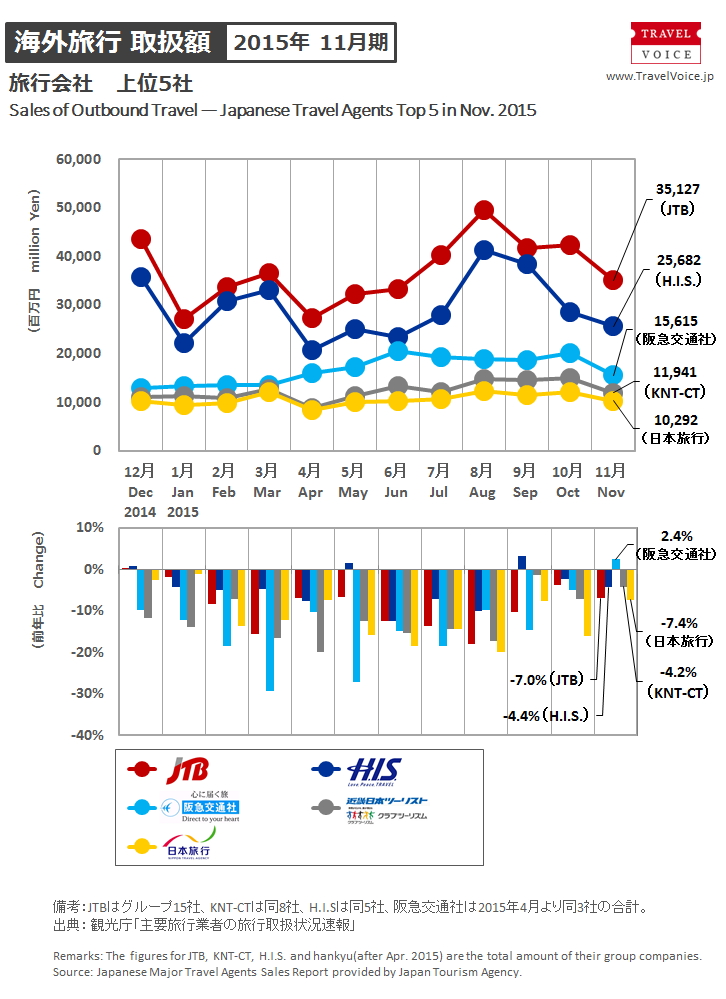

Among the top five travel agents (JTB, H.I.S., Hankyu, KNT-CT and NTA), only Hanky resulted in year-on-year reductions for outbound travel as follows:

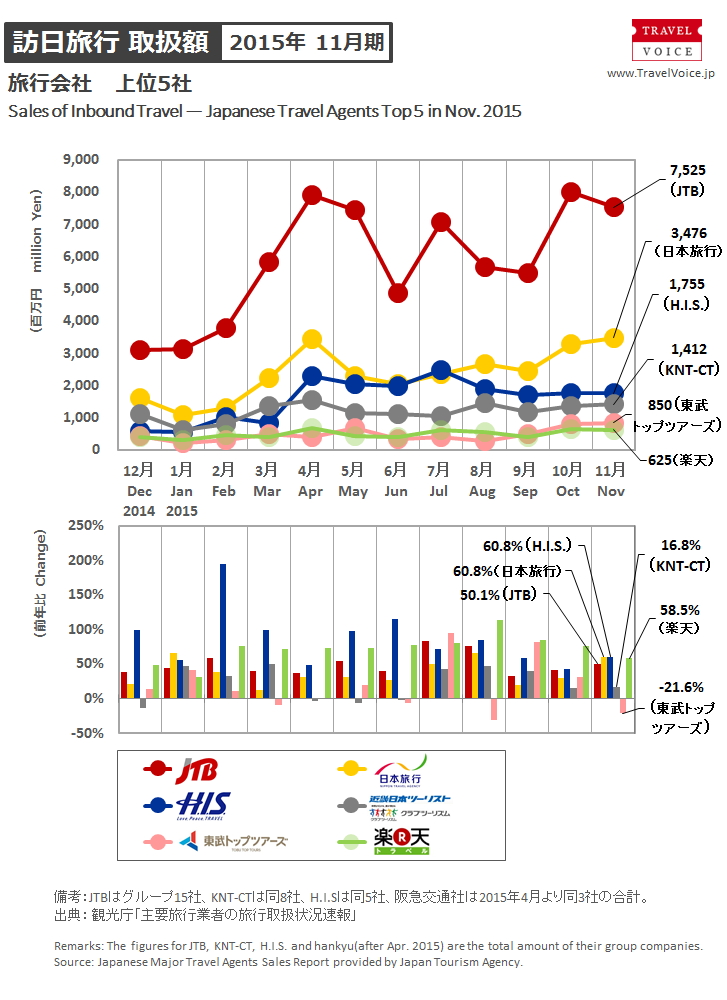

In the inbound travel market, NTA and H.I.S. achieved growths of 60% or more, and Rakuten also marked growth of 60%, however ranked 6th.

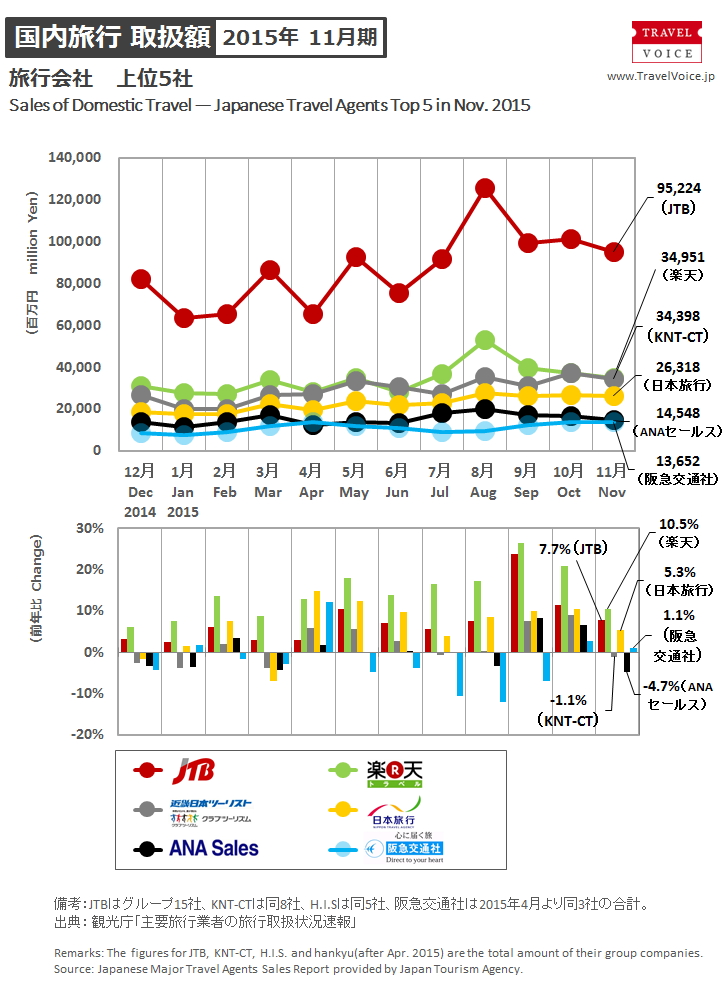

In the travel in Japan market, Rakuten resulted in double-digit growth and moved up to 2nd.

Transactions of package tour brand products totaled 124.9 billion JPY in November 2015 (-4.5%) with 3,336,689 customers in total (-5.4%), which comprised 571 million JPY (+21.8%) with 31,548 customers (+37.2%) for inbound travel, 45.4 billion JPY (-13.5%) with 237,688 customers (-11.2%) for outbound travel and 88.9 billion JPY (+0.7%) with 3,067,449 customers (-5.3%) for travel in Japan.

According to the hearings to travel agents, travelers from East Asia and Southeast Asia continued growing in the inbound travel market for a main reason of ease of visa rules. In the travel in Japan market, popularity of travel to Kansai and Hokuriku was still high. In the outbound travel market, weak yen continued discouraging Japanese travelers to go abroad for leisure particularly to Europe.

In Japanese