Four major Japanese OTAs of Rakuten Travel, Jalan (Recruit Life Style), Ikyu (Yahoo! Japan Grpup) and i.JTB came together at WIT Japan 2017, and. the Q&A session showed their strategies for the next moves.

The followings are each OTA’s answers to Q1: happy figure, Q2: disappointed figure, Q3: booking rate on smart phone

Yoshiyuki Takano, Business Manager of Travel Business, Rakuten

Q1: 20%, a market share of Rakuten in the domestic guest nights based on Japan Tourism Agency’s statistics

Q2: #2, the 2nd largest travel transactions in 2016

Q3: 60% in a peak season, out of which 50% are from the app

Yoshiyuki Takano, Rakuten

Yoshiyuki Takano, RakutenKenichiro Miyamoto, the head of travel division for Recruit Lifestyle

Q1: 17975, enriching the number of activities available for bookings

Q2: +6%, the growth rate of transactions based on booking receipts in FY2016

Q3: undisclosed

Kenichiro Miyamoto, Recruit Lifestyle

Kenichiro Miyamoto, Recruit LifestyleJun Sakaki, Ikyu CEO

Q1: x2 visitors, doubling visitors to the Ikyu site

Q2: up to 5%, the ratio of inbound travelers’ bookings

Q3: 40 to 50%, out of which 10 to 20% are from the app

Jun Sakaki, Ikyu

Jun Sakaki, IkyuKen Mishima, Vice President Ecommerce Strategy, iJTB

Q1: 13,000,000 USD (about 1.4 billion JPY), record-high sales of the B to C online business

Q2: 7 million guest nights in vacation rental properties in Japan according to the JTB survey

Q3: 30 to 40%, from mostly browsers on smart phones

Ken Mishima, iJTB

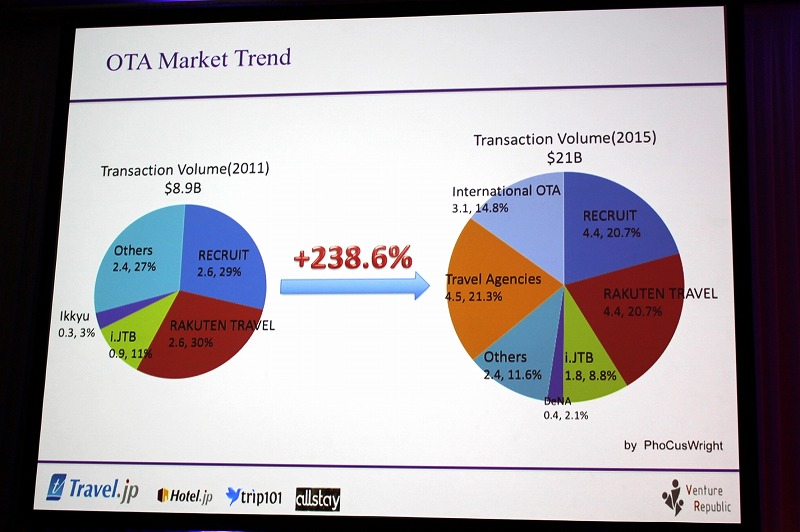

Ken Mishima, iJTBIn Japan, booking distribution amount increased by 238.6% in 2015 compared to 2011, according to Phocuswright. A marker share of Japanese OTAs, however, was down, while international OTAs have raised their presences in Japan. Asked how much percentage of a sense of crisis against international OTAs, Rakuten Takano answered 100%, while Ikyu Sakaki interestingly 0%. Sakaki said that Ikyu increases a market share in its major business to sell domestic lodgings in Japan, focusing on its target customers.

Takano referred to threats of international OTAs that spend vast budgets in technology and marketing, however emphasized that Rakuten as a group has a strong business and customer base in Japan, which is superior to international OTAs.

i. JTB Mishima reduced the percentage from 100% in the beginning to 50% in the end, saying that JTB can take advantages of both 800 real shops nationwide and online, citing Amazon forming a real shop network as an example.

Asked how to use 100 billion JPY for the next investment, Recruit Miyamoto answered creation of domestic demands, and Ikyu Sakaki said exploration of restaurants in Japan. Rakuten Takano chose AI, forecasting that AI in the travel industry will mainly be a recommendation engine based on big data.Ikyu Sakaki added that AI is used for personalization of search results and optimization of parameters.