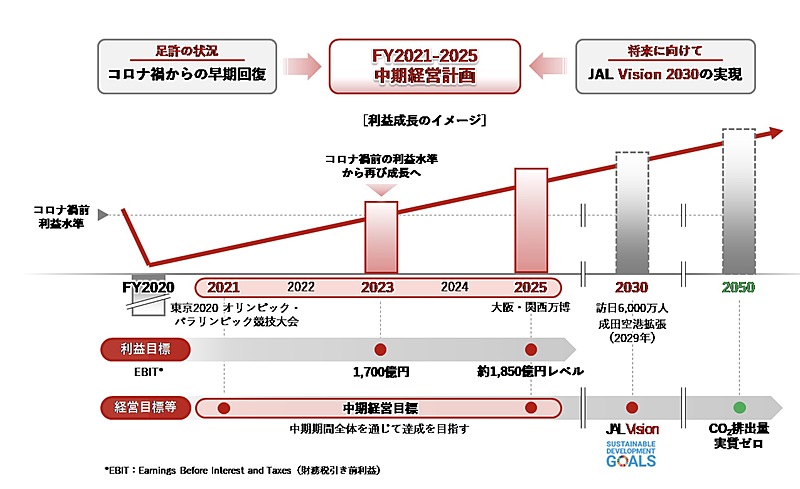

JAL has drawn up a new FY2021-FY2025 medium-term management plan toward its longterm goal of ‘JAL Vision 2030,’ focusing on realizing “Safety and Comfort” and “Sustainability” as the engine for future growth. Addressing the plan, JAL aims to restore EBIT to 170 billion JPY, more than the pre-pandemic level, in FY2023 and to about 185 billion JPY in FY2025.

報道資料より

報道資料より

Under the plan, JAL is developing three management strategies of Business Strategy, Finance Strategy and ESG Strategy.

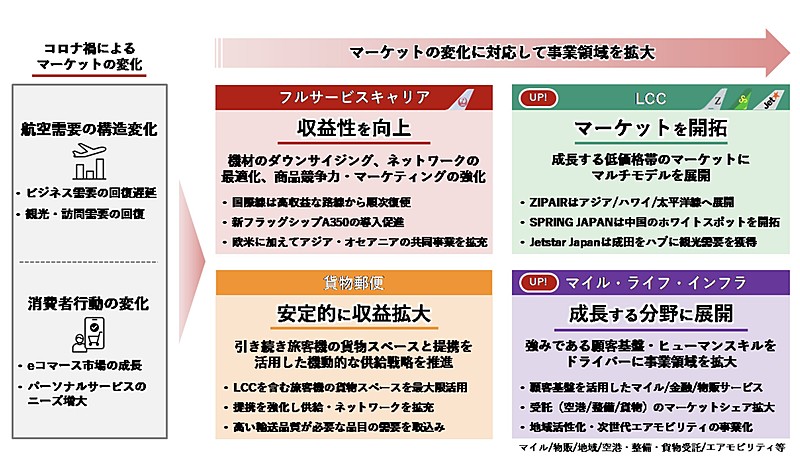

For Business Strategy, JAL is trying to improve the profitability of the full-service carrier business by optimizing our equipment and network and to ensure stable earnings in the cargo mail business. In the LCC market, JAL is taking advantage of networks of ZIPAIR, SPRING JAPAN and Jetstar Japan. Acquisition of SPRING JAPAN as a subsidiary will be completed in June this year. In addition, JAL is expanding its business in mileage, regional revitalization, commissioned business and next-generation air.

報道資料より

報道資料より

For Finance Strategy, JAL is enhancing its financial base for the first three years to ease financial damage by the pandemic to take health financial base back by FY2023. Also, JAL is trying to secure the amount of 5.0 to 5.6 months worth of passenger revenue for liquidity and to recover the equity ratio from currently 45% to 50% by FY2023.

For ESG Strategy, JAL identifies 22 issues and about 180 initiatives in the four areas of Environment, People, Local communities, and governance. A environmental goal is to reduce total CO2 emissions to virtually zero in 2050 through replacement of fuel-efficient aircraft, innovations in flight operations and the use of alternative aviation fuels.